2015 is coming in a few days! Are you excited on what’s in store for us in the coming new year? I am! What are you most looking forward to? What are your goals that you would want to achieve?

One of my goals is to have financial freedom. Four years ago, I started investing in mutual funds (MF) and got our life insurance with investments both from Sunlife. This 2014, I opened a Unit Investment Trust Fund (UITF) in BPI, a Citisec Financial account and another MF with PhilEquity. I don’t have a lot of money and we are not rich but because of financial literate circle of friends, I wanted to start seriously saving for my family’s future. As they say, it is always better to start saving NOW.

Last year, I came across a one-of-a-kind challenge of saving money in a year. It is the 52-Week Money Challenge that I learned from friends who saw it from this blog. Basically, the idea of the challenge is to save weekly for one whole year. The amount to be saved weekly is by increments of 10, 20, 30, 40, 50 or whatever amount you want to start with. It can depend on how much you want to save for a particular goal and of course, on your income.

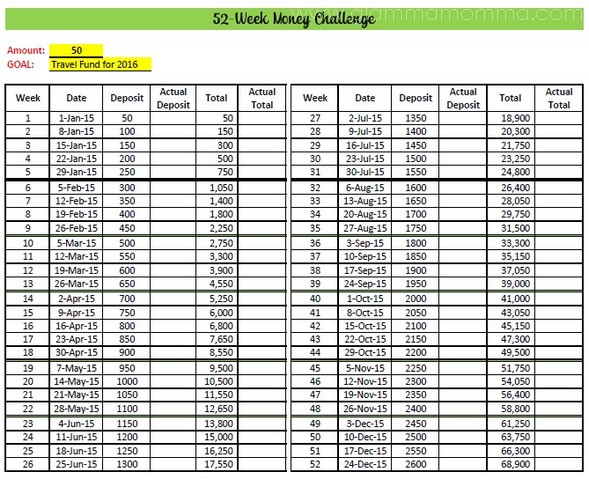

Here is a chart I made in Excel using increments of 50. You can be strict in following the amount to be saved weekly or you can skip a week and then add that missed week to another week. Just make sure you can catch up with the total amount. My goal is to have another international travel with my family in 2016. So I’m taking this challenge to add to our travel fund what I can save here.

If you noticed, the amount to be saved in January is very easy to do but it becomes more challenging towards the end of the year (Think about the expenses during Christmas season). You can use your 13-month pay for the bulk amount to be saved in December. But this won’t work for me since I don’t get to have a bonus pay in my work 🙁

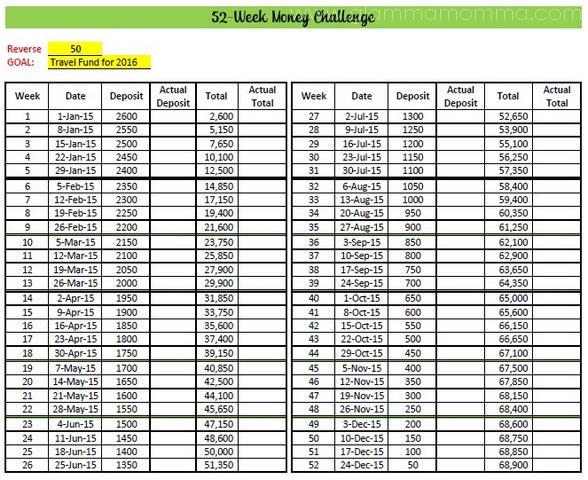

So, instead of doing the chart above, I joined a few friends who will be taking the challenge but doing the REVERSE 50 52-Week Money Challenge.

Here is the chart I will be using:

Basically, I will be saving the higher amount at the start of 2015 so it would be easier towards the end of 2015. So starting January 1, 2015, the excess money we got from monetary gifts this Christmas will already be used for this challenge. I’ve read that others will be using the traditional piggy bank, jars or open a new bank account solely for this. For me, maybe I’ll use my BPI Save-Up account or look for a big piggy bank lol!

Good bye to unecessary expenses! Good luck to me! 🙂 Good luck also to my family and friends who will also be doing this money challenge.

You can download the excel files I made here (these are the revised files, thanks for those who noticed the error) –> 52WeekMoneyChallenge and 52WeekMoneyChallenge_Reverse. This templates use the increments of 50. Just change the amount and it will automatically compute. Don’t forget to put your goal! 🙂

I’d like to accomplish this challenge, the reverse one and I hope to be able to save that amount by December 2015! Goodluck to me!

Kaya natin ito Lanie! 🙂 Bawal na mag file ng LOA lol!

Hi your topic was so interesting, i wanted to do the challenge too. since i am also investing in banks that offer high interest rates, it’s the military banks.this year i rwill be opening another bank acct because my savings has dividend already.It’s so fulfilling if you see your earnings. Thsnjd for the info.

Hi Mimi! I was just greatly encouraged by my friends 🙂 it’s fun to take a challenge if you know a lot who are doing it also 🙂

Hello, hindi ko naintindhan ng kaunti, but i just wanted to know that every jan 1,8,15,22,29, need to deposit? or pwede 1x lang mag deposit per month?

I found this again! I used to start this 2014, but stopped on the month of July because of emergency funds. Thanks for bringing this up again! 🙂

Crossing my fingers that I would be able to complete this challenge 🙂 Good luck to us!

so this means that you need to be earning more than 10,000 pesos by December so you can make that more than 2000 peso deposit… hmmmm…..

Hi! You can change your base amount. Instead of 50 pesos, make it 10, 20 or 30 🙂 You can do it!

Hi i would just like to share that instead of doing the usual way and the reverse, what I do is, I do it alternately.

Example

week 1 – 50 pesos

week 2 – 2600

Week 3 – 100

Week 4 – 2550

And so on

Because I think trying to save around 2500 a week, is really challenging if your income is not that high. So by doing it alternately, I get to save money at the same time I still have money to spend for myself.

That’s a great strategy, Jen! Thanks for sharing 🙂

you can do also a 1325 per week

this is much better, sakto kasi mostly 15-30 ang sweldo 🙂

Hi. I’ve downloaded a copy of your Reverse 50 template and noticed something wrong with it. When I changed the increment (or base amount), it seems that the computations for the entire file was incorrect. Perhaps it’s because of the content you entered on the cell for the first week deposit. It should be dependent on what increment you chose, right? If you would check the file, the amount 2600 was entered as it is (and it shouldn’t be entered that way). I suggest that for that cell, multiply the increment cell by 52 so that it will become dependent on whatever base amount you enter. 🙂

I already revised the files. Thanks for noticing the error 🙂

well i have been browsing my FB account and i had seen this.. its quite a great idea… i guess this one was the best idea/challenge for this year.. ill try this and make u some results. lets do this together ^^,

Goodluck to us Thrifty Challengers!

Thanks for this helpful info…

I will do this challenge

I want to be a member. How?

Thank you posting the 52 week Money Challenge!

When I read your post, I said, “wow!” and “ay!” at the same time. Your goals are also my goals. The financial vehicles that you mentioned are the ones that I would like to venture into. I admire what you have accomplished so far, and I envy you too.

This goal is from the bottom of my heart, and I have programmed my mind, for 2015, that I’m financially free already, so I guess I attracted your blog; (“whatever you focus on, expands,” as they say).

So my plan is to set-up the Reverse Money Challenge first. In your opinion, what should I need to join next? MF from SunLife or the one from PhilEquity?

Thanks for the inspiration. Keep it up.

Thank you so much! I’m a student so i though of removing a zero for every number and also, Ill do it on reverse. Thank you for posting this great idea. This is a great way to save money 😀

It’s good that you’re starting to save at a young age. Keep it up!

I think just like in business,if you are just a starter saving the small amount would be more effective until saving some your income becomes your habit.

Hi!

Me and my hubby just agreed to do this challenge. I believe its going to be easier if its done together plus bigger amount of money saved by the end of the year since we can double the amount saved per week 😉

Hi,

If you’re going to change the increments, I think you also need to change the amount of the first deposit especially when using the reverse format because the succeeding deposit amounts relies from the initial deposit.

For example, using the reverse format, if you’re going to change the increments to 100, you also need to change the initial deposit amount to 5200 so that your final deposit (52nd) will equal to 100 🙂

Revision done on the file 🙂 Thanks!

Hi jen thanks for sharing this. Iknow i can do it for my family since my goal is to fixed or renovate our house, i’m going to this every year. Tnx.

Maybe i can start at 100 or the alternate way it depends on how much money i have every week but assuring to follow every week that i have money in my piggy bank.

I’ll do the challenge but I’ll make a few changes to match my salary. Thanks …

Wow Thanks to your Brilliant Idea I will start ASAP Hahahahahah

Can you please so this in US dollars?

ive been wanting to save money for specific reason but not successful until i saw this today. Looks xciting and challenging im gonna try this. So so xcited

ill take the challenge too.

This very interesting and challenging move for 2015 .Ill take the challenge too

hi.. i downloaded it but it doesnt compute.. how so?

Hi Selene! Kindly download it again. I made a few changes. Just put your desired increment in cell B3 🙂

Could it be more effective if you just save 175 daily?

Hi! You can also make your own strategy that best suits your lifestyle. I think monitoring daily is a little bit time consuming. You can also do it every two weeks (when salary comes in) or monthly.

Thanks for the spreadsheet 🙂

I will find it hard towards the end, but it’ll be worth it.

THANK YOU FOR POSTING THIS. I WILL TRY THIS CHALLENGE WITH A LITTLE TWEAKING. NICE SITE.

This 52-week challenge looks like fun! I’ve read another blog about this but with a lower base amount. I’m also into personal finance stuff, and I find this activity interesting! Thanks for sharing this! 🙂

Andy

http://andygulle.blogspot.com/2014/12/where-did-your-bonus-go.html

Already take the challenge! I wish I can do it till the end. Help me God. Thank you for sharing this.

Very helpful.

This is interesting. Will surely try this together with the financial calendar I got from another blog. Works well with me. 🙂

I actually tried to do this last year kaso I wasn’t able to completely finish it. Ang hirap na once nasa mataas na amount na.

Mommy Cha

http://mommyandbabypot.blogspot.com/2015/01/9-tips-on-saving-your-money.html

ill try for this,

Hope I can do this in 2016..

I have tried saving and failed for the nth time. I hope this will work this time.I do not want to give up just yet.

Thank you so much for the template. I have saved and copied it in three different sheets- one for my husband, one for my son and one for me. My son agreed to try the 2 peso increment for a start while my husband and I wanted the twenty peso and thirty peso increments respectively. I hope that we could finish the challenge.

We chose smaller amounts since those are what we could afford and so that we would not be disappointed if we could not come up with the higher amounts.